In 2022, a flood of sanctions and restrictions hit Russia in response to the full-scale invasion of Ukraine. Such leading Russian concerns as Sberbank, Aeroflot, Rostech, Russian Railways, Rosneft, and Gazprom have been added to the ban list.

Despite this impressive number of sanctioned companies, one exception is the Corporation ROSATOM.

Why does one of the largest Russian corporations specializing in nuclear power and developing nuclear fuel continue to operate in the international market?

How is it possible that, despite the closure of the skies in European countries to Russian aircraft, the corporation’s aircraft continue to fly to European Union countries?

ROSATOM is an instrument of Moscow’s imperial policy

On September 1, 2022, the Russian-occupied city of Energodar hosted a foreign delegation. After 6 months of negotiations at the highest level, a mission of the International Atomic Energy Agency, IAEA, arrived at the Zaporizhzhya nuclear power plant, the largest in Europe.

The deputy from Abkhazia, Renat Karchaa, headed the mission from the Russian side. The Russian media called Karchaa a “nuclear expert,” while others said he was an “advisor” to Rosatom Director General Alexei Likhachev.

Officially, Alexei Likhachev justified the presence of ROSATOM representatives at the occupied Ukrainian nuclear power plants with nuclear safety regulations.

In March 2022, he told the head of the IAEA that the Russian corporation allegedly did not interfere in the operation of the power plants but only provided “consultations” to the personnel.

However, according to Ukrainian intelligence, while Russia was blackmailing the world with a nuclear disaster, ROSATOM was creating a plan to disconnect the same Zaporizhzhya nuclear power plant from the Ukrainian energy system. At the same time, the Russian Federation was building a military facility at the NPP.

Although Russian representatives have not connected the Zaporizhzhya plant to their power grid, the plant has remained idle since September, and any attempts by Energoatom (the Ukrainian state nuclear company) to restart it end in yet another bombardment of the power plant.

According to the IAEA mission’s conclusions, all nuclear safety norms have been violated at the plant. The plant personnel are under psychological pressure, and the “nuclear safety zone” that Ukraine and the IAEA are asking for because of Russia’s refusal looks futile.

Why is the Rosatom case unique?

Today, Rosatom includes 300 subsidiaries with 275,000 employees. The corporation’s profits for 2021 are about $21 billion. In 2021, Russia received $9 billion from nuclear technology exports, $5 billion of which – or the most significant portion – came from building new nuclear power plants abroad, according to calculations by The Yermak-McFaul International working group.

Even before the war, in the summer of 2021, the Russian portfolio of overseas orders included 35 new projects worth $140 billion. In particular, the corporation began building nuclear power plants in Turkey, Egypt, India, Hungary, and China. It owns the only nuclear power plant in Belarus and another 37 power units in Russia.

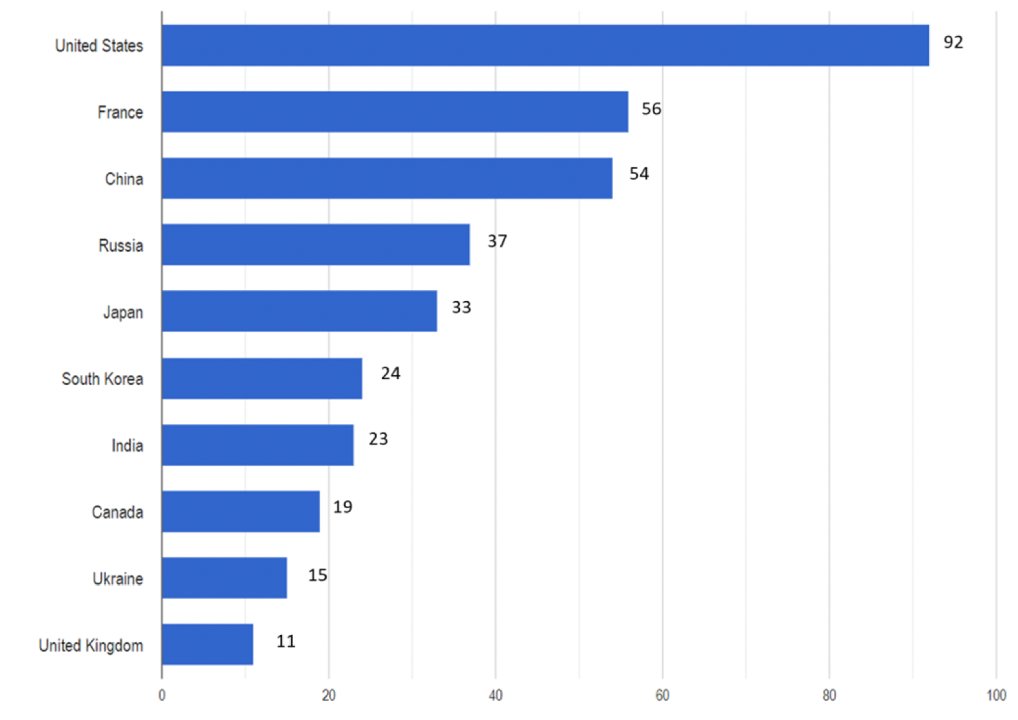

Countries with the largest number of nuclear reactors

However, ROSATOM also has other sources of income. According to a study by the Center for Global Energy Policy at Columbia University, the Russian state corporation controls about 40% of the global market of highly enriched uranium.

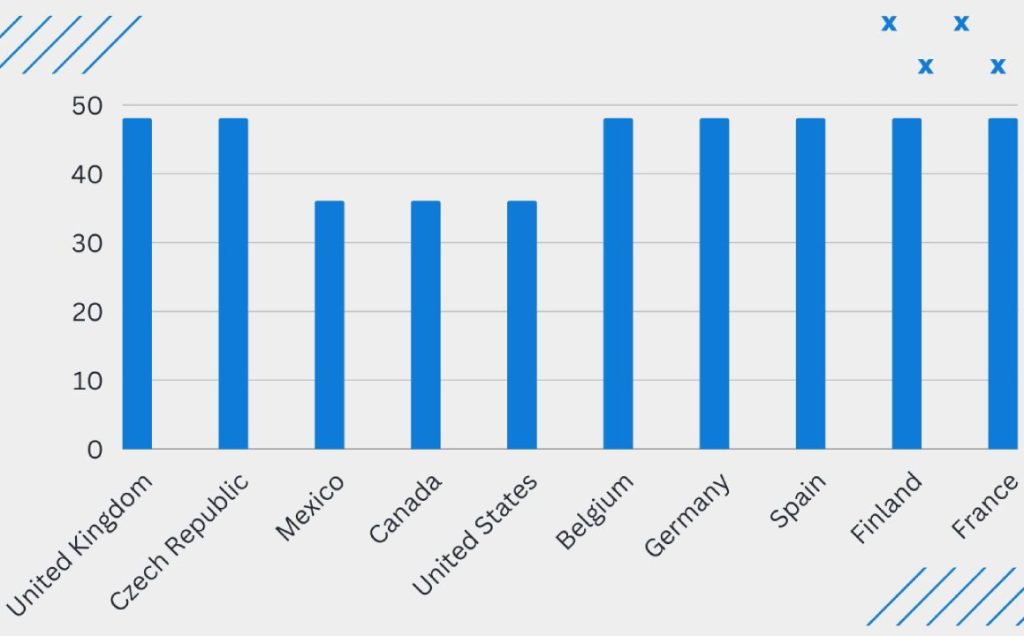

ROSATOM enriches and supplies uranium to the European Union, China, Great Britain, Mexico, and even the United States. For example, EU countries, on average, depend on Russian services by 26%, while the United States, Canada, and Mexico – by 36%. This is evidenced by a 2022 study by the Austrian Federal Environment Agency.

On the other hand, ROSATOM owes its success not only to its market share. International alliances also contribute to this. Électricité de France (French operator), one of the main allies of the state corporation in Europe – despite all calls from Ukraine, France initiated an exemption for ROSATOM from the EU sanctions.

Traditionally, Hungary is against any anti-Russian sanctions in the EU. This is because France and Hungary have cooperated with the Russian monopoly for many years.

Moreover, in Hungary, Russia plans to build two nuclear power units for $12.4 bln, while in France, ROSATOM is considered a strategic partner, supplying up to 50% of nuclear fuel. France is second only to the U.S. in the number of nuclear power units in operation, with 56.

Sanctions policy

The nuclear market is niche enough to impose sanctions as a package. The state can replace oil, gas, or coal supply sources from other countries, and nuclear fuel has a specific production cycle. And you must do more than replace that sector.

Until the European Union has an alternative to ROSATOM, Europe is unlikely to agree to sanctions. There are at least four countries in the EU that are 100 percent dependent on Russian nuclear fuel, according to a study by the Austrian Environmental Department: Bulgaria, Hungary, the Czech Republic, and Slovakia.

Countries dependent on Rosatom for uranium enrichment services

In November, the Yermak-McFaul International Working Group even developed a separate draft of possible restrictions against the nuclear giant from Russia if a “nuclear incident” were to occur at the Zaporizhzhya NPP.

In particular, the group proposed excluding Rosatom from almost all intergovernmental agreements, “expelling diplomats affiliated with Rosatom,” and taking control of its investments abroad. According to the draft’s text, exceptions are provided only if it concerns nuclear security and the proliferation of weapons of mass destruction.

At least some of these proposals, according to Reuters, the EU may adopt as early as the tenth sanctions package, which is being prepared for the anniversary of the Russian Federation’s invasion of Ukraine. In particular, the possibility of putting “Rosatom and/or its management on the EU blacklist” is considered.